sales tax calculator buffalo ny

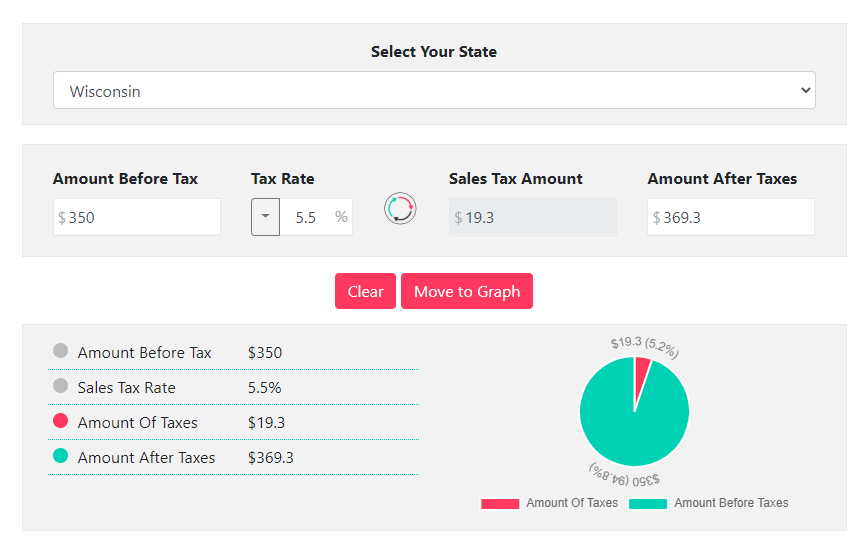

Sales Tax Amount Net Price x Sales Tax Percentage 100 Total Price Net Price Sales Tax Amount. An additional sales tax rate of.

New York Property Tax Calculator 2020 Empire Center For Public Policy

2022 Tentative Assessment Roll.

. Or to make things even easier. Search results are sorted by a combination of factors. The minimum combined 2022 sales tax rate for Buffalo New York is.

To calculate the amount of sales tax to charge in New York City use this simple formula. 4 hours agoBuffalo NY 50 Buffalo NY. Pursuant to the New York State Real Property Tax Law The Department of Assessment and Taxation is responsible for the implementation of a fair and equitable assessed valuation of all.

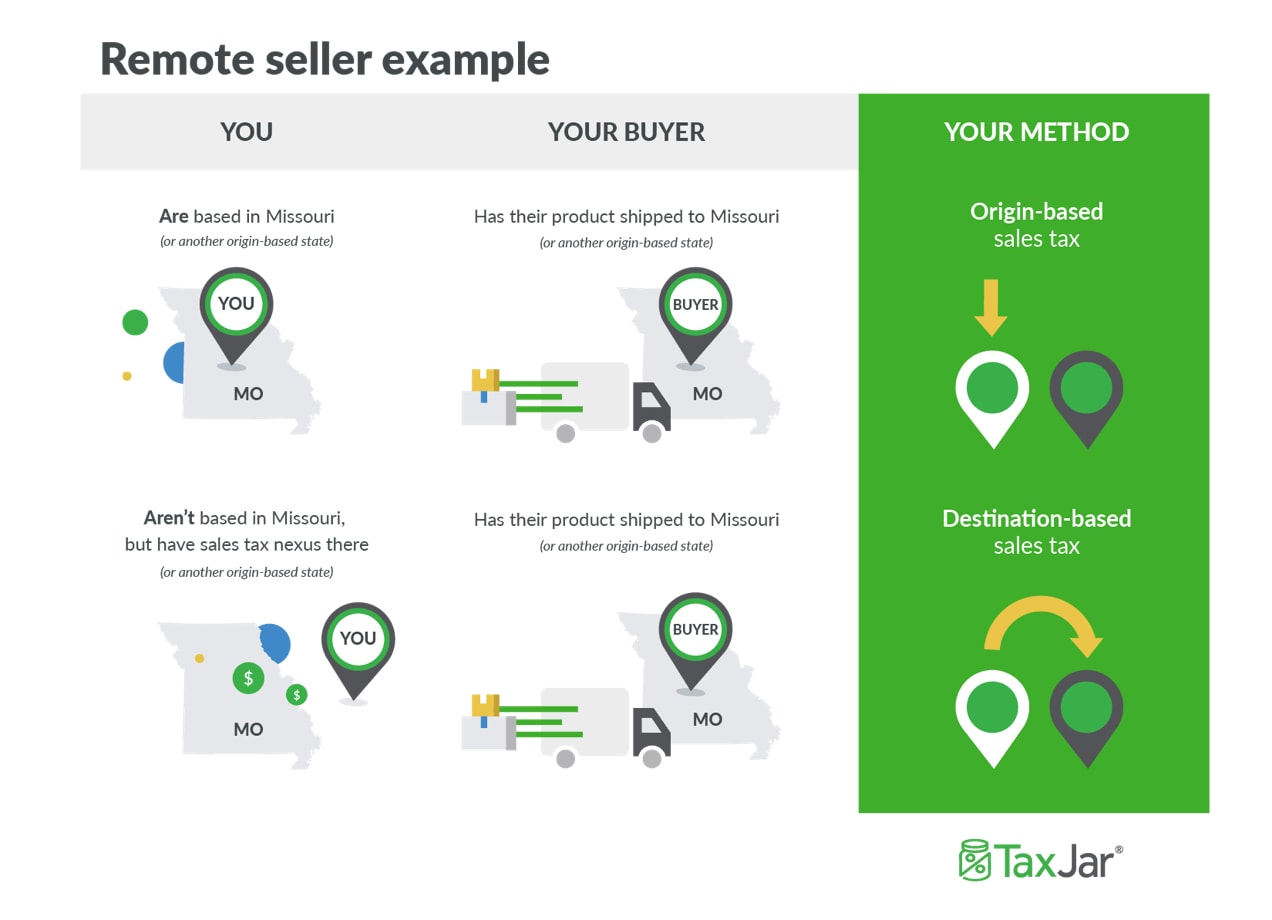

Usually the vendor collects the sales tax from the consumer as the consumer makes a. The combined sales and use tax rate equals the state rate currently 4 plus any local tax rate imposed by a city county or school district. The recently enacted New York State budget suspended certain taxes on motor fuel and diesel motor fuel effective June 1 2022.

Sales taxes for a city or county in New York can be as high as 475 meaning you could potentially pay a total of 875 sales tax for a vehicle in the state. NY Sales Tax Rate. Brooklyn NY Sales Tax Rate.

0125 lower than the maximum sales tax in NY. This is the total of state county and city sales tax rates. Sales tax total amount of sale x sales tax rate in this case 8.

The New York sales tax rate is currently. New York has a 4 statewide sales tax rate but also has 640 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4254. NYS Taxes 0342.

Cheektowaga NY Sales Tax Rate. Sales Tax Calculator in Buffalo NY. At 4 New Yorks sales tax rate is one of the highest in the country.

Erie County Tax NYS Petroleum Testing Fee. Real property tax on median home. Base pay range 4100000yr - 6900000yr.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. This means that depending on. Brentwood NY Sales Tax Rate.

Subscribe to Sales tax to receive emails as we issue. During a special meeting on Monday county legislators unanimously voted 10-0 to cap the sales tax on gas at 300 per gallon one of. Actual pay may be different this range is estimated based on Tax Accountant in Buffalo New York United States at similar companies.

The lowest city tax. NYS Petroleum Business Tax. Buffalo NY Sales Tax Rate.

However all counties collect additional surcharges on top of that 4 rate. There is no applicable city tax or. The 875 sales tax rate in Buffalo consists of 4 New York state sales tax and 475 Erie County sales tax.

The current total local sales tax rate in Buffalo NY is 8750. Federal Tax 0184. Sales Tax State Local Sales Tax on Food.

YP - The Real Yellow Pages SM - helps you find the right local businesses to meet your specific needs. The December 2020 total local sales tax rate was also 8750. Just enter the five-digit zip.

2022 Final Assessment Roll.

New York Vehicle Sales Tax Fees Calculator

How To Charge Your Customers The Correct Sales Tax Rates

Sales Use Tax South Dakota Department Of Revenue

How To Calculate New York Sales Tax 14 Steps With Pictures

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

Ny S Tax Climate Again Ranks At National Bottom Buffalo Niagara Partnership

Which States Require Sales Tax On Clothing Taxjar

Online Sales Tax Compliance Ecommerce Guide For 2022

New York Sales Tax Guide And Calculator 2022 Taxjar

How To Charge Your Customers The Correct Sales Tax Rates

Sst Simplified Malaysian Sales Tax Guide Mypf My

New York Vehicle Sales Tax Fees Calculator

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

New York Vehicle Sales Tax Fees Calculator

How To Calculate New York Sales Tax 14 Steps With Pictures

How To Charge Your Customers The Correct Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates